The US$25 billion container ship "order wave" pushed the global new ship orders to a 7-year high in the first half of the year, but this unprecedented round of "order wave" seems to be slowing down, with rapidly rising ship prices and fewer and fewer docks. The market has gone from "excitement" to "coolness". For most shipyards with insufficient orders, it may be more important to pay attention to the demand for ship types in the future market.

New ship orders hit a 7-year high, and container ships hold up "half the sky"

According to Clarkson's statistics, in the first half of this year, the number of new ship orders reached 23.8 million CGT totaling US$52 billion, the highest level since 2014, and has surpassed the 21.9 million CGT total of US$47.5 billion in 2020. However, the current hand-held orders account for only 8% of the existing fleet capacity, which is still close to historical lows.

The main reason for the increase in new ship orders is the overall improvement in the shipping market, especially the container ship market. In the first half of the year, the Clark Sea Index reached an average of US$21,717, the highest level of semi-annual data since 2008.

Among the orders for new ships in the first half of the year, container ships accounted for more than half of the total, with a total of 12.7 million CGT and US$25 billion. In contrast, orders for oil tankers and bulk carriers are only 3.5 million CGT and 2.5 million CGT. The shipyard also said that the current container ship inquiry is still continuing, mainly in the new Panamax and small and medium-sized ships, but the oil tanker inquiry is very limited, because the current oil tanker market continues to be weak and the prospects are full of uncertainties.

Despite the gratifying performance in the first half of the year, shipbrokers generally believe that new ship orders will tend to flatten out in the second half of this year. One of the reasons is that the rise in shipboard prices has caused shipyards to increase the price of newbuildings accordingly. On the other hand, the delivery schedule of major shipyards in China and South Korea by 2023 is basically full, and equipment vendors have reached their maximum production capacity.

The Baltic International Chamber of Shipping (BIMCO) does not seem to be optimistic about the level of orders this year. In its latest analysis and forecast, BIMCO pointed out that although the number of new container ship orders this year is at a 14-year high, global shipyards are still facing the pressure of insufficient orders. Based on the current pace of market order growth, it is estimated that the overall new ship orders in 2021 will be It is the third lowest level in the past 12 years.

The fleet growth rate will slow down in the next 5 years, and the LNG fleet will grow the fastest

BIMCO further predicts that the growth rate of the global fleet will slow down in the next five years, with the largest increase in the LNG fleet, but the container ship sector may not be able to maintain the current high growth for a long time.

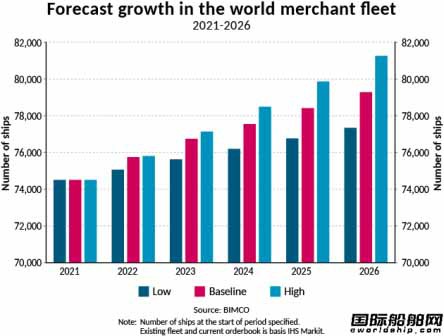

BIMCO pointed out that at the beginning of 2021, the global trading merchant fleet had 74,505 ships, covering 11 major ship types. BIMCO simulated three fleet growth scenarios. In the baseline scenario, the total fleet is expected to reach 79,282 by 2025, an increase of 6.4%, which is lower than the 7.4% increase in the past five years. Starting from 2021, the global fleet’s compound annual growth rate (CAGR) is forecast to be 1.25%, lower than the 1.44% in the past five years.

At the same time, BIMCO also provides a high-growth scenario and a low-growth scenario to consider the impact of varying degrees of uncertainty on the number of ships in the future market.

Among them, the low-growth scenario predicts that the global fleet will grow at a compound annual growth rate of 0.75% in the next five years, and an average of 567 new ships will be added each year, which is much lower than the 955 in the baseline scenario. In the high-growth scenario, BIMCO predicts that the compound annual growth rate in the next five years will reach 1.75%, and the total fleet will exceed 80,000 ships by 2025.

According to BIMCO's forecast, among the 11 main ship types in the next five years, the highest growth rate of the fleet may be LNG ships. At present, the global LNG fleet has a total of 593 ships, 85% of which have a capacity between 100,000 and 200,000 cubic meters. BIMCO predicts that under the baseline scenario, the compound annual growth rate of the LNG fleet will reach 6.7%, and the final fleet will increase to 819 by the end of 2025. Under the low-growth scenario, the total fleet may eventually reach 799 ships, and under the high-growth scenario, the total fleet will reach 839 ships.

In addition, the cruise fleet will also grow substantially in the next five years. Although cruise ships are the second smallest ship type in the global merchant fleet by number, with a total of 621 ships as of the end of 2020, BIMCO expects that the compound annual growth rate of the cruise fleet will reach 4.2% in the next five years under the baseline scenario, and by 2025 The fleet increased to 763 ships.

In the field of crude oil ships, although the market continued to be weak during the epidemic, BIMCO pointed out that the number of orders for crude oil ships has exceeded 40 this year. According to previous data from IHS Markit, the crude oil fleet has a total of 2,976 ships, 34% of which have a capacity of 80,000 to 120,000 dwt. BIMCO predicts that the compound annual growth rate of the crude oil fleet i will reach 2.8% by the end of 2025, with VLCC being the main growth driver.

Container ships are currently the fastest growing area of the fleet. According to BIMCO data, the number of new container ship orders has reached 229 so far this year, totaling 220 TEU, and the total delivery volume is 393,566 TEU. The current hand-held orders amount to 4.35 million TEU, which is almost two of the only 1.95 million TEU when it fell to a trough eight months ago. Times more. Surging profits and super-high freight demand have promoted the growth of container ship orders, but BIMCO believes that it is unlikely that container ships will maintain the current growth rate.

BIMCO also pointed out that the growth of the fleet will directly affect seafarers and the industry. Seafarers have been under tremendous pressure during the epidemic, and the expected demand for seafarers in the future will be affected by the forecast of world fleet growth.