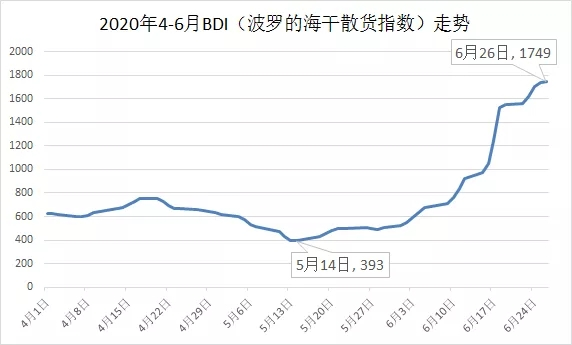

The Baltic Dry index has surged since June, recovering nearly fourfold from its lows in the past month to its highest level in nearly seven months.

The BDI rose for the third week in a row, rising 192 points on June 17, its biggest one-day percentage gain on record.On June 18, BDI rose 22.55% from the previous month, the largest one-day increase in history.On June 19th the BDI closed at 1555. During the week, the BDI rose from 973 on June 15th to 1555, a weekly gain of almost 60%.On June 26, BDI was at 1749, up 236% from the start of the month and hitting a record high for the year.

The Baltic Dry Index, a barometer of the global economy, reflects changes in spot freight rates on several of the world's main routes.It mainly involves grain, iron ore, coal and other grain and raw material transportation, and the prosperity of the economy is closely related.

Capesize (Capesize), Panamax (Panamax) and Supramax (Supramax) are respectively 40%, 30% and 30%.Among them, capesize ships carry a load of over 80,000 tons, which is mainly used for long-distance transportation of industrial materials such as iron ore and coal; Panama-type ships carry a load of 50,000-80,000 tons, mainly for transporting grain, sugar and other livelihood materials; super-flexible ships carry a load of less than 50,000 tons, mainly for transporting grain, fertilizer, cement and other products.

Since the novel Coronavirus outbreak sparked a global freeze in trade, the index plunged to a low of 393 in early May and has soared nearly fourfold.

Industry experts said the rebound was mainly due to the recovery of China's demand for iron ore, but also reflects the strong resilience of the Chinese economy and its growth potential.

Since the second quarter, the domestic economy has picked up fast, with companies restocking inventories and spending on infrastructure investment picking up, leading to a surge in demand for iron ore.The data show that the iron ore freight from Brazil to Qingdao and Australia to Qingdao iron ore sea freight has been significantly increased.In addition, increased coal shipments from the United States and Australia also contributed to the BDI's rise.Capesize ships, which are used mainly for transporting iron ore, have seen earnings rise and the freight index has rebounded 600 per cent from its lows, the main reason for the recent surge in the Baltic Dry index.

Randy Giveans, vice President of equity research at Jefferies, an investment bank, said the strength of the BDI was due to increased demand for iron ore from Chinese mills, as well as increased production and exports from Brazil.In his view, the duration of the rally depends entirely on how aggressively China rebuilds inventories and the strength of the economic recovery and stimulus activity under way in Asia.

Masanari Takada, cross-asset strategist at Nomura, said in a research note that the rise in the Baltic Dry index reflects both the recent pick-up in Chinese demand and a recovery in trade activity in parts of the world following the "quarantine".

However, experts say the threat of a blockade remains as the outbreak returns, which could derail the ongoing global economic recovery and depress the international shipping market.Even if the economy recovers, the long-depressed shipping industry and resource producers will need more government policy support.

The sharp rise in the BDI index has also led to a surge in daily rents for medium and large bulk carriers, particularly capesize and Panamax bulk carriers.

In the case of Capesize bulk carriers, the recovery of iron ore demand in the Far East has led to a strong increase in the daily charter of Capesize vessels. In the past week, the daily charter of Capesize vessels increased by 90% to break through the level of $20,000. On June 18th and 19th, both of them stood at $25,000, exceeding the average profit and loss of spot vessels of $14,000.

At the same time, in the field of Panamax bulk carrier, the demand in the Atlantic region is hot, especially in South America and the Gulf of Mexico continues to increase, which drives the daily rent of Panamax vessel keeps increasing. In addition, the supply of ships in the Atlantic region is relatively tight, so the daily rent of panamax vessel is close to $10,000, with a weekly increase of nearly 40%.

In small bulk carriers in the market, will be from the beginning of the outbreak of coronavirus Europe and the United States after the peak, at the end of April to transport grain of small bulk carrier, the rent has been steady rise, nearly a week also steadily upward, super handy-size ships nearly a Sunday rent increases about 7%, close to rise about 32% in January, handy-size ships nearly a week to rise about 15%, close to rise about 54% in January.Rising demand from the European Union and the Mediterranean, as well as from the eastern coast of South America and the US Gulf of Mexico, was the main driver of the daily rent increase.

Analysts pointed out that although the epidemic situation in Brazil, the United States, Russia and other countries is still severe, restrictions in Europe and other places have been gradually eased, and the demand for infrastructure is expected to improve, which will be a driving force for the continuous improvement of the demand for bulk transportation.